Building a diversified portfolio with international equities and bonds

Diversification is vital for sound investing. A mix of assets like equities and bonds is better than relying on just one. According to our 2024 Diversification Landscape report, predicting winning asset classes each year is impossible.

Although real estate and high-yield bonds don’t diversify portfolios well, international equities from developed markets do. Including cash, commodities, and alternative investments also helps. But, one must know the risks involved. For a well-rounded portfolio, balancing larger-cap stocks and high-quality bonds is key.

Key Takeaways:

- Diversification is a core principle of sound investing.

- A well-diversified portfolio includes assets with different performance characteristics.

- It is impossible to predict which asset class will perform well in a given year.

- Correlations between stocks and bonds have increased, but bonds still provide diversification benefits.

- Real estate and high-yield bonds may not be the best portfolio diversifiers.

The importance of diversification in portfolio management

Diversification is key in managing risk in investment portfolios. It involves adding various types of assets to reduce the chance of big losses. By spreading investments across different areas, investors lower the risk of losing a lot if one part does poorly.

Asset allocation plays a big role in this by choosing the right mix of stocks, bonds, and more. This choice considers what an investor aims for, how long they can invest, and their comfort with risk. It can help get better results and lower overall risk.

“Diversification is the only free lunch in investing.”

Harry Markowitz’s quote underlines how important diversification is. It means we can earn more without taking extra risk, or make risks smaller without losing too much potential gain.

A well-diversified portfolio is a mix that doesn’t rely on all stocks or all bonds. It’s made of different types that act differently when the market changes. For example, bonds give a steadier return when stocks are down, but stocks can give bigger profits when they rise.

Diversification not only lowers risk but also lets investors benefit from different areas. Putting money in only one industry or place can be very risky. But spreading investments across several areas can catch growth in different markets.

The power of asset allocation

Asset allocation divides a portfolio into areas like stocks, bonds, and more. This process helps reduce risk and matches an investor’s needs. Choosing the right mix of these can improve the investment’s risks and rewards.

A good mix in a portfolio includes stocks, bonds, and maybe real estate or other assets. It changes based on how old the investor is, what they want financially, and how much risk they can handle. For instance, young investors often have more stocks because they can wait out the ups and downs of the market.

The mix needs regular checks and sometimes adjustments. If an investor’s goals or risk comfort changes, the portfolio should too. This rebalancing keeps the portfolio in line with what the investor wants and needs.

In sum, diversification and smart asset allocation are key parts of keeping a portfolio healthy. They help lower the risk of losing big while keeping up with market opportunities. With the right choices and rechecking now and then, a portfolio can stay on track with its goals.

The benefits of international equities in a diversified portfolio

International equities are key in a varied portfolio, offering big advantages. They let you invest in global markets beyond just local stocks and bonds. This broadens your portfolio and can lead to more opportunities.

International stocks bring diversity to your investments. This means your money is spread out, reducing the risk of relying only on your home market. Such stocks can act differently from the U.S. market, offering both challenges and the chance to lower your risk level.

They also protect you from the ups and downs of currency values. This is important, especially in shaky economic times. Adding international equities can stabilize your portfolio during these tough periods.

It makes sense to consider these stocks for the benefits they bring. They give you access to many markets worldwide. But, always do your homework and consult a financial advisor. This ensures your money is moving in the right directions safely.

Remember, looking beyond your home borders is smart investing. It adds to your chances of doing well in the long run. Working with a mix of assets like bonds and real estate further improves your chances of success.

“Including international equities in your investment mix can help diversify your portfolio beyond domestic stocks and bonds, reducing risk and potentially enhancing your returns.”

The role of bonds in diversification

Bonds are key for making a portfolio diverse. They bring stability and income. In the past, they’ve shown less change than stocks. So, during tough times in the market, they can keep your money safe.

Bonds usually go up when stocks fall. This is good because it reduces your risk. If stocks are not doing well, your bond investments might be. So, they balance out the losses in your mixed portfolio.

There are many types of bonds investors can choose from. There are government, corporate, and municipal bonds. They can vary in how safe they are, the income they offer, and how soon you get your money back. This lets investors pick what’s best for them.

Government bonds are from the government and are seen as very safe. They pay you back with interest. And when things are uncertain, they are a popular choice for investors.

Corporate bonds come from businesses. They can make more money for you with higher interest rates. But, they’re a bit riskier. A credit rating tells you if the company is likely to pay you back.

Municipal bonds help fund things like schools and roads. They often don’t require you to pay taxes on the interest you earn. They are safer than corporate bonds.

Having a mix of different bonds can make your investment safer. You don’t rely on just one bond. If something goes wrong with one, the others can help keep your money safe.

So, bonds are very important to have in your investment mix. They bring safety, income, and they lower your risk. Mixing them well with stocks helps you smooth out market ups and downs.

Evaluating other asset classes for diversification

Investors should look beyond just stocks and bonds. Other assets help diversify and reduce risk. Let’s explore different strategies and assets that add value to a portfolio:

Real Estate

Real estate is great for diversification. It’s not closely tied to the stock market. You can invest in property to fight inflation, earn rent, or through REITs for income. It can also grow in value over time. But, remember, its diversification power can change based on location and market trends.

High-Yield Bonds

High-yield bonds come with more risk. They offer higher returns but are often linked to stocks. They might suffer during hard times. Investors need to check if they match their diversification goals and risk tolerance.

Cash

Cash is important for diversity, especially with rising interest rates. It helps you invest when the time is right. Holding cash can stabilize your portfolio and provide quick money if needed. Yet, it can lose value over time due to inflation.

Commodities

Commodities like gold and oil can diversify your portfolio. They don’t move in sync with stocks and bonds, lowering your overall risk. But, their prices can change a lot due to many global factors. Time and how much risk you’re willing to take are crucial when investing in commodities.

Alternative Strategies

Alternative strategies offer unique ways to diversify. They can include funds that don’t depend on how the stock market does. Some aim to earn money without following these common trends. Investing in these requires understanding their risks and making sure they suit your goals.

Adding various assets to your portfolio can boost how well you spread risk. Always evaluate risks to make sure your investments match what you’re comfortable with.

Implementing a diversified portfolio strategy

To build a diversified portfolio, you must think about a few things. This includes how to split your money, managing risks, and checking your investments often. With a solid investment plan, people can build wealth over time while keeping risks low.

The first thing to do for a diverse portfolio is to pick where to put your money. You decide how much to invest in things like stocks, bonds, and more. This choice should match your money goals, how long you plan to invest, and how much risk you’re okay with.

Dealing with risk is a big part of a smart investment plan. You lower risk by not putting all your money in one place, like one type of stock or one country. Spreading your money out means a bad hit in one area won’t hurt you too much.

It’s crucial to keep an eye on your investments and adjust from time to time. This process, called rebalancing, keeps your investments in line with your plan. It’s about making sure you don’t end up having too much in one area. This keeps your risk where you want it.

Sticking to your plan, even when the market is up and down, is important. Market ups and downs are normal. But sticking to your plan and looking at the long run helps you not make rash decisions when times are tough.

Building a diverse portfolio is an ongoing task, not a one-off event. You should keep checking how your investments are doing and tweak things when needed. This approach helps you make the most of your money over the long haul, all the while managing risks smarter.

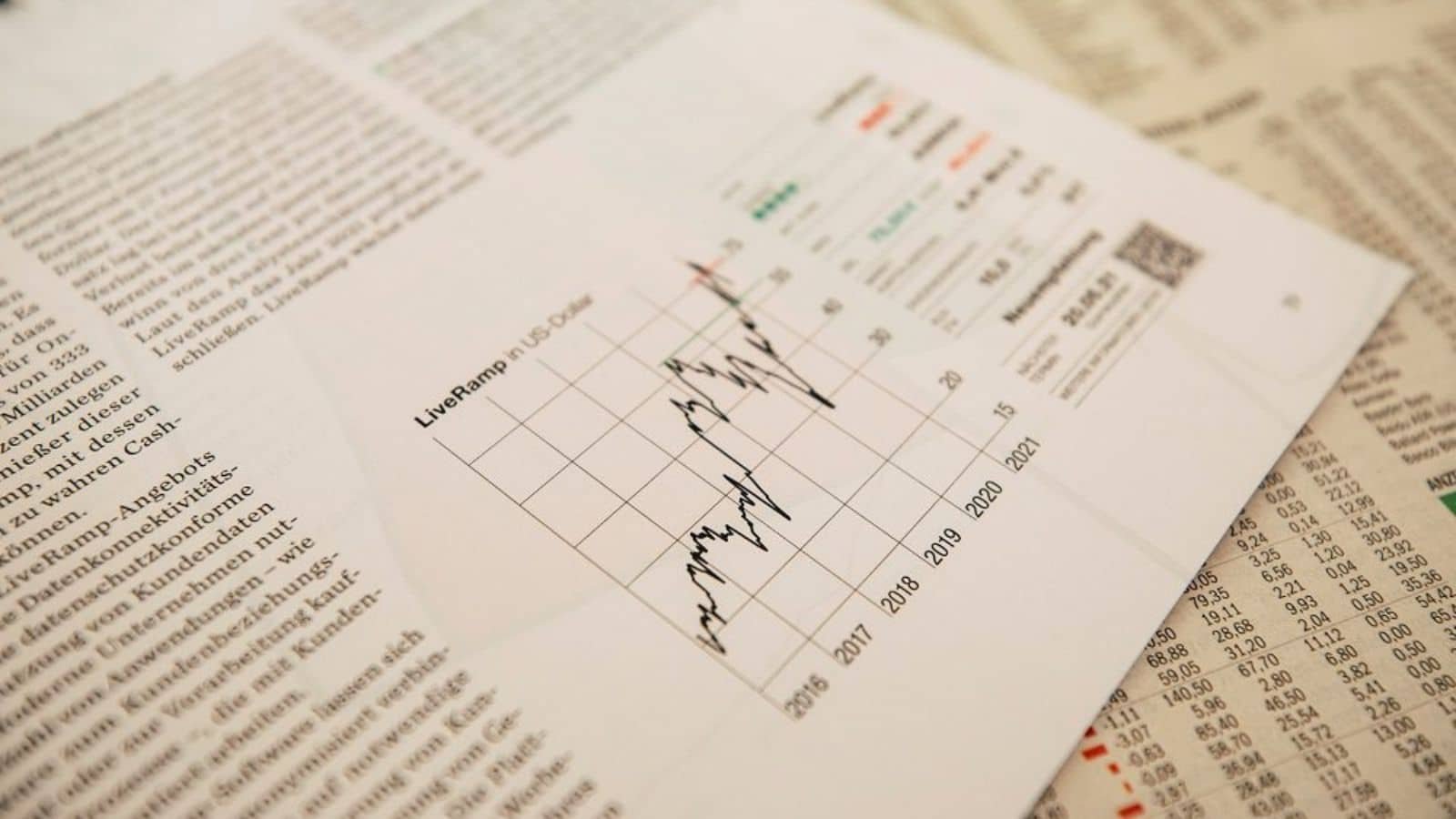

Image: Diversified Portfolio Strategy – Implementing a robust investment strategy helps achieve long-term wealth accumulation while managing risk effectively.

Conclusion

It’s important to build a varied portfolio for growth and risk reduction. By spreading your money across different types of investments and parts of the world, you can make your risks lower. This might also improve how much you earn compared to the risks you take. International stocks let you take part in markets worldwide, while bonds offer steady returns.

Adding more than stocks and bonds can make your portfolio even safer and more diverse. Real estate protects you from prices rising too fast and isn’t always closely tied to stocks. Keeping some cash is good when interest rates are getting higher. Gold and other goods can also improve how safe and diverse your investments are. New strategies that are not like the usual ways of investing are out there too.

To make this work, choose where to put your money based on your goals and how much risk you can handle. Reassessing your choices regularly is key to keeping your risks where you want them. With the right plan and sticking to it, you can grow your money over many years. And you can do this while keeping risks in check and aiming for the best possible results.