Small Business Management Tips: Navigating Challenges

Running a small business comes with its challenges. You’ve got to manage money and lead your team well. In this competitive world, how can you master this? What works to stay ahead? Let’s find out how to tackle tech changes and marketing moves in the small business scene.

Key Takeaways:

- Effective leadership is crucial for small business success.

- Financial management is essential for long-term stability.

- Productivity tips can help you optimize your resources.

- Well-planned marketing strategies are key to reaching your target audience.

- Adopting cost-effective solutions and utilizing technology can enhance your business operations.

Understanding the Strategic Management Landscape for Small Businesses

Strategic management helps small businesses succeed. It involves long-term planning and decision-making. Key aspects of this process are crucial for owners to know.

Financial Planning

At the heart of strategic management is financial planning. This means setting financial goals and managing money wisely. By crafting a clear financial plan, small businesses understand their money situation better. They can make smart choices.

Human Resource Management

Managing people well is key for small businesses. They need to attract and keep good workers. This means building a great company atmosphere, offering fair pay and benefits, and supporting employee growth. A strong team builds a strong business.

Innovation

Innovation keeps small businesses competitive. It’s about always looking for new ideas and better ways to do things. Companies that innovate stay ahead. They meet their customers’ changing needs better than others.

Legal Compliance

Staying on the right side of the law is a must. Small businesses have to follow many rules and laws. This covers employment, taxes, and data protection, among others. Knowing and following these laws keeps businesses out of trouble.

Understanding and acting on strategic management’s key parts is vital. It helps small businesses face challenges and thrive in the long run.

Identifying Key Challenges in the Competitive Market

Small businesses often struggle to grow due to key challenges in the competitive market. It’s crucial they understand and overcome these obstacles for long-term success. Let’s look at some common issues they face:

Limited Distribution Channels

Small businesses usually can’t reach as many people as big companies can. This is due to fewer ways to get their products out there. To beat this, they must use alternative methods like online sales and local store partnerships.

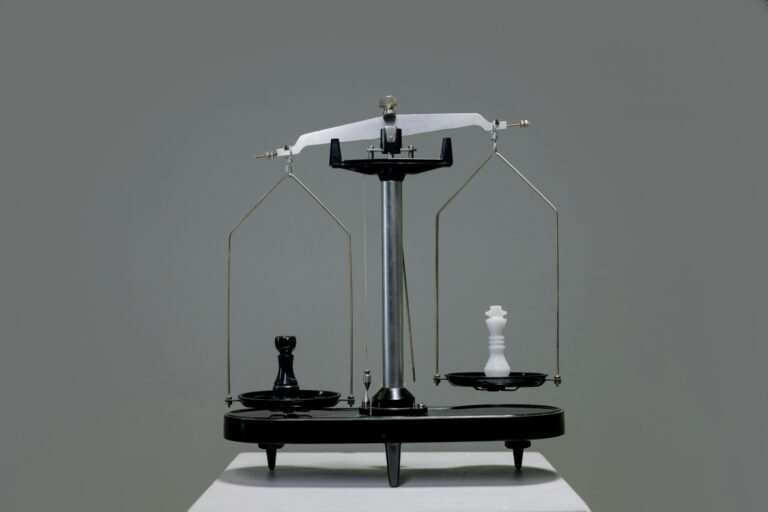

Market Competition

Competing against bigger companies is tough for small businesses. These rivals have more money and are well-known. Small businesses have to stand out by offering unique things, great service, and smart marketing to their specific audience.

Financial Constraints

Having little money is a big problem for small businesses. It limits what they can do in marketing and tech use. They should use cost-friendly methods like social media and look for grants or loans designed for small enterprises.

Tailored Business Strategies

A general plan doesn’t work for everyone. Small businesses need strategies that highlight what makes them special. By knowing their customers well, they can offer personalized services, niche products, and build strong relationships.

Technological Adoption

Using modern tech is key in today’s world, and not keeping up can leave small businesses behind. Tech can make operations smoother, improve customer service, and help compete with big businesses. It’s crucial they incorporate the right tech solutions into their workflows.

For small businesses to succeed in the competitive market, they must be ready to tackle these challenges head-on. They can grow by navigating distribution limits, outsmarting competition, managing finances wisely, following tailored strategies, and using technology effectively.

The Role of Strategic Planning in Overcoming Obstacles

Strategic planning is key for small businesses to beat obstacles and thrive in the long run. It acts as a guide to deal with money issues, limited resources, and more. Such planning helps owners tackle problems early, aiding growth and resilience.

Handling financial limits is a major part of strategic planning. Often, small businesses struggle because money is tight. By evaluating their finances and cutting unnecessary expenses, owners can use their funds wisely.

Building a strong team is also essential. Good teamwork pushes a small business ahead. By getting the right people and helping them grow, entrepreneurs can form a united, effective team. This team can lead to innovation and hit business targets.

Good management is crucial in strategic planning. Leaders need to oversee operations, set clear goals, and make sure the plan works. By promoting responsibility, talking well, and working together, owners can run things smoothly and make the best use of resources.

Adopting technology is important for small businesses too. The right tech can make work easier, boost productivity, and give an edge over competitors. This includes tools like project management software, data analytics, and customer systems. These can significantly help a business succeed.

To wrap up, strategic planning is a plan for small businesses to get past difficulties. By managing finances, forming a strong team, being good leaders, and using technology, owners can make their businesses more efficient and ready for growth.

Adapting to Economic Crises and Consumer Preferences

Small businesses must navigate through tough economic times and shifts in what consumers want. They need to be agile, adapting to the market and making smart choices.

Economic downturns shake consumer confidence and change spending habits. Businesses should watch market trends and what people feel. By staying flexible and adapting quickly, they can lessen the downturn’s blow and get ready for better times.

Shifts in consumer behavior are important in setting market trends. What consumers want changes due to new technology, societal shifts, and trends. It’s key for small businesses to keep up with these changes to meet customer needs and stay in the game.

Being agile is crucial for small businesses facing economic crises and changing consumer wants. This means reacting fast to market changes, updating products, and tweaking marketing strategies.

At the heart of getting through economic crises and shifts in consumer behavior is smart decision-making. Small businesses should study the market, spot trends, and make proactive choices to keep ahead.

Market Adaptation

Staying relevant during economic downturns and shifts in consumer behavior involves adapting to the market. Small businesses have several ways to do this:

- Do thorough market research to spot trends and what consumers want

- Ask for customer feedback to keep improving what they offer

- Keep up with tech to make operations smoother and connect with people

- Use a pricing strategy that matches market conditions and what customers expect

Strategic decision-making is key to adapting well to economic crises and shifts in what people want. This means looking at market info, weighing risks and chances, and choosing actions that fit with long-term goals.

| Challenge | Recommended Approach |

|---|---|

| Economic downturns | Watch market trends, tweak pricing and marketing, diversify how you make money |

| Consumer behavior shifts | Keep up with research, tailor products and services, boost how you engage with customers |

| Agility in business | Use technology, make operations smoother, be agile in thinking, put innovation first |

| Market adaptation | Research the market, connect with customers, use tech, and have flexible pricing |

| Strategic decision-making | Study market data, think about risks and chances, choose actions that fit long-term goals |

Navigating Financial Constraints and Cash Flow Management

Managing your cash flow well is key for small businesses. It means watching your cash, tracking expenses, and making sure payments are on time. Doing this helps you avoid money problems and keep a healthy financial status.

Keeping an eye on expenses is a big part of managing cash flow. Checking your expenses often can show you where to cut costs. This makes your cash flow positive and boosts your finances.

Having clear payment terms is vital. Tell your clients or customers your payment policies. Set up an invoicing and follow-up system. This ensures you get paid on time and avoid money issues.

“Proper cash flow management is like oxygen for your business. It keeps you healthy and allows you to thrive in any economic climate.” – John Smith, Financial Consultant

Getting advice from experts is also key in managing cash flow. Financial advisors or accountants can offer advice on boosting your cash flow. They can spot risks and help with financial planning.

Benefits of Effective Cash Flow Management:

- Improved financial health

- Greater control over business finances

- Ability to meet financial obligations on time

- Reduced risk of bankruptcy or insolvency

- Opportunity for growth and investment

| Tips | Description |

|---|---|

| 1. Monitor cash flow regularly | Keep a close eye on your income and expenses to identify potential cash flow issues. |

| 2. Understand your payment terms | Clearly communicate your payment terms to clients and ensure they understand when and how to make payments. |

| 3. Track and categorize expenses | Keep a detailed record of all business expenses and categorize them to identify areas of improvement. |

| 4. Invoice promptly | Create and send invoices promptly to ensure timely payments from clients or customers. |

| 5. Consider credit and payment terms | Evaluate the credit terms you offer to customers and negotiate favorable payment terms with suppliers or vendors. |

| 6. Establish an emergency fund | Set aside a portion of your revenue as an emergency fund to cover unexpected expenses or revenue shortfalls. |

By using these strategies and getting advice when needed, you can handle financial challenges. This ensures your small business stays financially healthy in the long run.

Securing Funding and Managing Operational Costs

Getting funds and managing costs well is key for a small business to keep going. Looking at different ways to get money and planning finances wisely helps. Owners can then spend wisely while also putting money into growth and new ideas.

Small businesses can choose from many funding sources. Options include bank loans, venture capital, crowdfunding, or government grants. Looking into each carefully helps find what works best for your business.

Having a solid financial plan is also crucial for growth. This means setting up a budget, planning for the future, and understanding risks. Knowing your finances well lets you make smart choices and use your money in the best way.

Keeping an eye on spending is important too. Reviewing costs often helps you see where you can spend less. You might negotiate better deals, find ways to save, or choose different suppliers.

Yet, it’s not all about saving money. Investing in new tech, improving products, or entering new markets is also key. Setting aside money for these investments can help your business succeed in the long run.

Case Study: XYZ Bakery

“XYZ Bakery got a government grant and bought advanced baking equipment. This boosted their efficiency and quality, letting them offer more products. With good financial planning and cost control, they grew sustainably while keeping profits high.”

To wrap up, finding funds and managing costs wisely are vital for a small business. By considering various funding sources, planning finances, watching expenses, and investing in growth, owners can lead their businesses to ongoing growth and success.

The Importance of Cash Budgets and Financial Planning

Cash budgets and financial planning are key for small business growth. Managing cash flow and assessing risks helps keep your business stable for the long run. Getting expert advice and using forecasts are great for making big decisions.

With cash budgets, you can watch your business’s cash closely. This lets you see trends and financial issues early on. By knowing where your cash is going, you can handle expenses better and keep your finances healthy.

Good financial planning isn’t just about watching your cash. It’s about looking ahead, making financial goals, and spotting risks and chances. Risk assessments let you see what might happen in different situations. Then, you can plan to avoid problems. This way, you make choices that fit your business goals and dodge possible problems.

Even if you know your industry well, advice from financial pros can be really helpful. They can give you a full plan, check how your business is doing, and suggest ways to grow. Their knowledge and tips can give you an advantage and improve your financial planning and risk handling.

Benefits of Cash Budgets and Financial Planning:

- Improved cash flow management and financial stability

- Enhanced decision-making based on accurate financial forecasts

- Greater control over expenses and resource allocation

- Minimized financial risks and improved risk assessment

- Strategic financial planning for long-term growth and success

Good financial planning and managing risks are vital for small businesses today. By using cash budgets, doing risk checks, and getting professional advice, you can build a strong financial base. This will help your business grow and succeed in the future.

Tackling Skill Shortages and Competent Labor Acquisition

Small businesses often struggle to find skilled workers. Keeping them can also be hard. Yet, it’s possible to attract and keep the talent you need with good strategies.

A clear company vision can pull in skilled workers. They want to know how their skills will help. Share your company’s mission and goals to attract talented people.

Offering competitive benefits also draws in skilled workers. Today, they want more than just pay. They look for work-life balance, growth chances, and health care. Adding flexible work, learning opportunities, and good health plans can make your company stand out.

“Having a strong company vision and offering competitive benefits are key to attracting skilled workers for your small business.”

Investing in professional development attracts and keeps skilled workers. They want to grow in their careers. Show them you value their growth by providing learning opportunities.

Creating an agile workforce is key to beating skill shortages. This means making a team that adapts, works together, and keeps learning. Encourage them to learn different skills, try new projects, and be creative.

With these strategies, small businesses can attract and keep skilled workers better. This helps them to compete and succeed in the market.

| Benefits of Tackling Skill Shortages and Competent Labor Acquisition |

|---|

| 1. Attracting highly skilled professionals |

| 2. Retaining top talent |

| 3. Driving innovation and creativity |

| 4. Enhancing company culture and employee satisfaction |

Overcoming Marketing Challenges for Small Businesses

Marketing is key for small business success. Yet, it’s often hard due to small budgets and the need to find the right customers. Using digital marketing and getting expert advice can help overcome these challenges.

1. Harnessing Unique Strengths

Small businesses have things that make them stand out. It could be unique customer service, special knowledge, or one-of-a-kind products. By highlighting what makes your business unique, you can attract and keep customers.

2. Targeting the Right Audience

It’s tough for small businesses to target the right audience with limited resources. But, doing careful market research and understanding your customer can help. Use this knowledge to create effective marketing that speaks directly to them.

3. Embracing Technology Adoption

Staying up-to-date with technology is a must for small businesses to stay in the game. Using social media, SEO, and email marketing can boost your reach. Tools like CRM systems can make marketing simpler, letting you focus more on your business.

“Technology adoption is no longer an option for small businesses; it’s a necessity to survive and thrive in today’s digital era.”

4. Measuring ROI and Performance

It’s vital to check if your marketing is working by looking at the return on investment (ROI). Setting clear goals, tracking progress, and using analytics can show you what’s effective. This information helps you make better marketing decisions.

5. Seeking Professional Guidance

Getting help from marketing professionals can be a big help for small businesses. Working with consultants or joining groups can offer new insights and access to resources. This support can guide you through challenges and improve your marketing tactics.

By focusing on strengths, using technology, targeting well, checking progress, and getting advice, small businesses can face marketing challenges. These steps can lead to growth and success in the competitive business world.

Resolving Overhead Costs for Small Business Efficiency

Improving small business efficiency involves tackling overhead costs. This means knowing what customers want, cutting out what’s not needed, analyzing costs, and adding value. Doing these can make a business more profitable and competitive.

Understanding Customer Needs

To cut overhead, make sure your business matches what customers need. Do market research and get feedback. This tells you what’s important to them.

Focus your offerings on these needs to prevent wasting resources. This way, you’re smart about how you use your resources and cut costs.

Trimming Unnecessary Services

Look at your services and cut ones that don’t do well or aren’t profitable. This streamlines your work and reduces costs.

Keep services that customers value and align with your goals. This focuses resources on more profitable growth areas.

Cost Analysis and Optimization

Do a deep dive into your costs to see where you can spend less. This could mean talking to suppliers for better deals or finding cheaper options.

Consider outsourcing or using tech to cut labor costs. Keep your inventory lean to avoid waste. Keeping an eye on costs helps lower them and increase profits.

Value-Added Offers

Adding extra value can set you apart and draw in customers. Think about what extras you can offer that meet their wants.

This could be custom experiences, easy delivery, or special deals. These extras can lead to higher prices and more customer loyalty, helping to cover added costs.

“By addressing overhead costs and tailoring services to meet customer needs, small businesses can unlock new opportunities for growth and profitability.” – [Real name and position]

| Overhead Cost Category | Cost Reduction Strategies |

|---|---|

| Rent and Utilities | Consider downsizing office space, negotiating lower rent rates, implementing energy-efficient solutions |

| Insurance | Evaluate different insurance providers to find competitive rates and coverage options |

| Office Supplies and Equipment | Explore bulk purchasing options, leasing equipment instead of buying, and digitalizing processes to reduce paper usage |

| Marketing and Advertising | Focus on targeted digital marketing channels, utilize social media platforms, and track ROI to optimize marketing spend |

| Employee Benefits | Review benefit packages to ensure they align with the needs of your workforce while managing costs effectively |

Conclusion

Running a small business means facing many hurdles and complex issues. To tackle these, follow the management tips we mentioned. These strategies help in dealing with challenges and pushing growth. They cover strategic planning, adapting to changes, and knowing what customers want. Each plays a key role in success.

To stand strong, focus on planning your finances, managing cash flow, and learning new skills. This ensures your business stays financially sound and has a skilled team. Also, solve marketing problems by finding your audience, using technology, and getting expert advice. Cutting unnecessary costs and boosting efficiency are also key.

Good business management means being fast, flexible, and making smart choices. With the tips from this article, business owners can face challenges head-on. They can drive their businesses towards success. This puts them in a great spot in the tough market.